There are just over two weeks until the tax season ends on April 15, 2025, but that is not the topic that has brought us here. I only mention it because that date also coincides with the deadline to claim stimulus checks issued in 2021 and that a million Americans have yet to claim, even four years later in 2025.

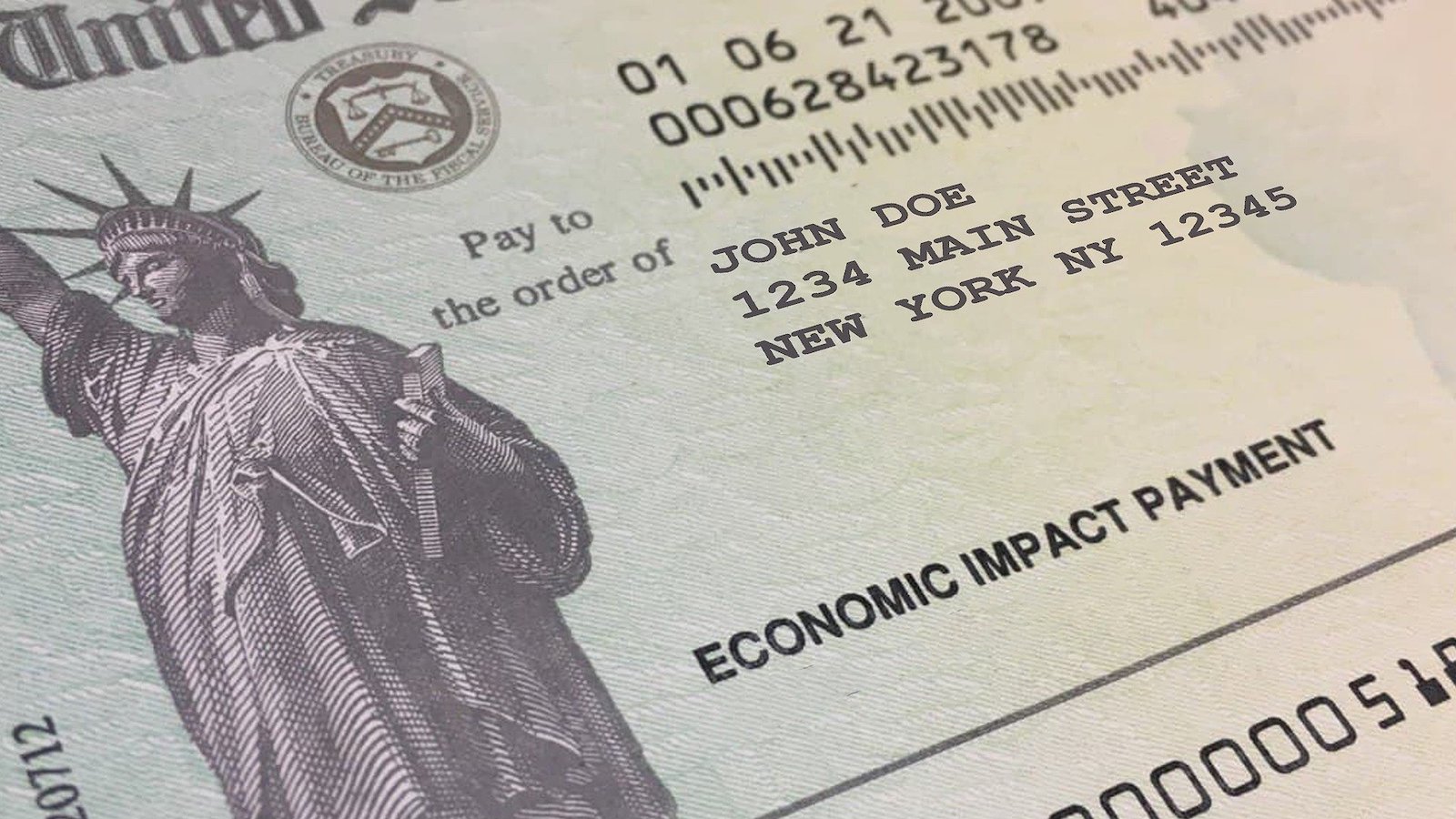

Just over 1 million Americans are eligible to claim unspent stimulus checks of up to $1,400, which could be lost forever if the application process is not completed by April 15. These are payments made under a federal initiative known as “Economic Impact Payments” that was implemented during the COVID pandemic.

According to the IRS, the majority of those 1 million taxpayers made a mistake on their 2021 tax returns by leaving the “Recover Refund Credit” space blank or filling it out as $0 when they were eligible.

The federal government will distribute more than $2.4 billion in stimulus checks

If you are eligible to receive this money, you will most likely not be required to complete any additional paperwork. However, if you have not yet filed your 2021 tax return, you still have time to do so before receiving the payment.

This applies even if you earned very little or nothing that year. The only requirement is that you complete your declaration and send it by April 15, which is the deadline.

The government will send payments automatically using data that it already has. If you normally receive your refunds via direct deposit, the funds will be transferred to that account.

Otherwise, you will receive a physical check in the mail. In addition, all beneficiaries will receive an official letter confirming the payment amount and method.

What’s the primary key? If you haven’t filed your 2021 taxes yet, make sure you do so before April 15! It is the only requirement you may need to meet to receive this benefit.

What happens if I don’t claim my “Recover Refund Credit” by April 15?

If you fail to file your claim by that date, the money will automatically become the property of the Federal Government, with the Treasury taking possession.

This means that the money will no longer be yours, but will instead be used by the nation for administrative expenses or whatever else they deem necessary. Once this occurs, there is no turning back: you will never see the money again, and there is no way to recover it.