Retirement is a goal many workers in the United States strive for, but how expensive is it really? Saving for retirement has become a major concern for many Americans as costs continue to rise. In this article, we will explore the various factors that make retirement expensive in the U.S., including healthcare, living expenses, and the overall cost of living. By understanding these factors, workers can better prepare themselves for a financially stable future after retirement.

Factors Affecting Retirement Costs in the United States

When considering the costs of retirement in the U.S., it is essential to account for several factors. These factors impact the total amount needed for a comfortable retirement and vary depending on the state and personal lifestyle.

Healthcare Costs

Healthcare is one of the largest expenses for retirees in the United States. With age, health issues tend to increase, leading to higher medical costs. Here’s a breakdown of healthcare expenses for retirees:

- Medicare premiums: Most Americans will rely on Medicare after 65, but premiums and out-of-pocket costs can still be high.

- Private insurance: Many retirees opt for supplemental health insurance, which adds to the total healthcare expenditure.

- Prescription drugs: The cost of medications often increases with age, creating another financial burden.

Healthcare costs in the United States can easily reach tens of thousands of dollars annually, making it a significant portion of retirement expenses.

Housing and Living Expenses

Housing is another major factor that makes retirement expensive. As people age, they may want to downsize or move to a more comfortable living arrangement. The cost of housing can vary greatly depending on the location and type of housing chosen.

- Mortgage payments: Some retirees may still have mortgage payments, which can drain finances.

- Renting: If renting, monthly rent payments can consume a large part of retirement income.

- Home maintenance: Even if a retiree owns a home, maintenance and property taxes can add up.

The overall cost of living in different states also affects retirement planning. States like California and New York are known for their high living costs, while others like Texas and Florida offer more affordable options.

Transportation Costs

As retirees often no longer rely on work-related transportation, they may have more time to travel or use public transportation. However, transportation still plays a role in retirement costs.

- Car expenses: Maintaining a car can be costly, with fuel, insurance, and repairs.

- Public transportation: In some cities, retirees rely on public transportation, which may also incur monthly costs.

Traveling during retirement, whether for leisure or visits to family, can also increase the overall expenses. Budgeting for these transportation costs is essential for retirees to maintain a comfortable lifestyle.

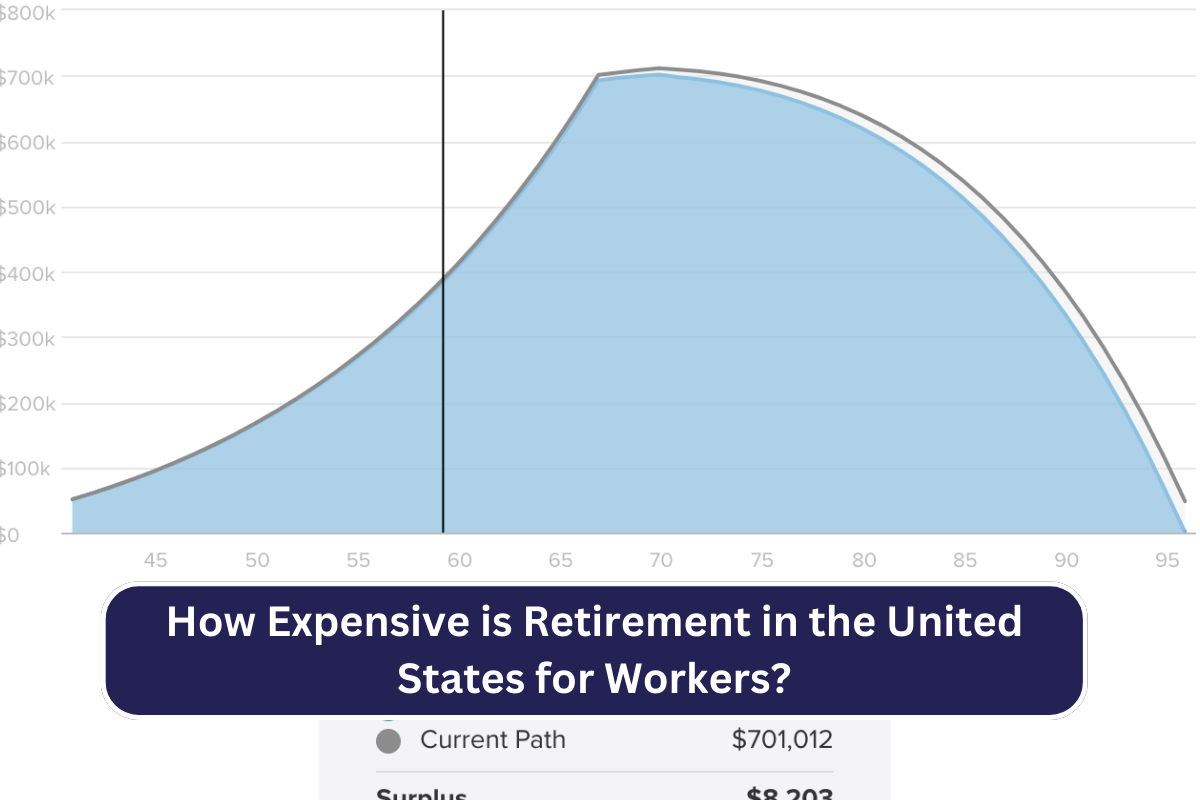

How Much Money is Needed for Retirement in the U.S.?

To estimate how much money is needed for retirement, it’s important to consider the average costs faced by retirees. Financial experts suggest that retirees will need about 70-80% of their pre-retirement income annually to live comfortably. Here’s a closer look at the required amount:

Average Annual Expenses for Retirees

- Housing: $10,000 to $20,000 per year

- Healthcare: $5,000 to $10,000 per year

- Food and utilities: $6,000 to $12,000 per year

- Transportation: $4,000 to $6,000 per year

This means that, on average, a retiree will need between $25,000 to $50,000 annually for basic living expenses. These costs may increase depending on personal preferences and lifestyle choices.

Savings for Retirement

A common rule of thumb is to save at least 15% of your annual income towards retirement. This percentage can vary based on when you start saving and your anticipated retirement age. Many financial advisors suggest aiming for a retirement savings fund of at least $1 million to live comfortably.

How to Prepare for the High Cost of Retirement

Planning ahead for retirement is key to avoiding financial stress in the later years of life. There are several strategies to help prepare for the high cost of retirement.

Start Saving Early

The earlier you start saving for retirement, the more time your money has to grow. Starting early can provide you with a solid financial foundation and help you reach your retirement savings goals.

- Employer-sponsored plans: Contribute to 401(k) or other retirement plans offered by your employer.

- Personal savings: Open a retirement savings account such as an IRA to continue building wealth.

Reduce Debt

Reducing debt before retirement is crucial. Carrying debt into retirement can add unnecessary financial stress. Pay off high-interest debts like credit cards and loans before retiring.

Create a Budget

Living within your means during retirement is important. Establish a monthly budget that accounts for all expenses and savings goals. This will help you avoid overspending and ensure that your retirement lasts as long as possible.

Conclusion: How Expensive is Retirement in the United States for Workers?

Retirement in the United States can be expensive due to factors like healthcare, housing, and transportation. However, with proper planning and saving, workers can minimize the financial burden of retirement. It is essential to start saving early, reduce debt, and create a realistic budget for retirement. By taking these steps, retirees can enjoy their later years without financial worries.

FAQs

1. How much does healthcare cost for retirees in the U.S.?

Healthcare costs for retirees can vary widely, but on average, Medicare premiums and out-of-pocket costs can exceed $10,000 annually.

2. What are the main expenses in retirement?

The main expenses in retirement include healthcare, housing, food, utilities, and transportation.

3. How much money should I save for retirement?

Experts recommend saving at least 15% of your income annually for retirement, with a goal of reaching $1 million in savings.

4. Is living in the U.S. expensive for retirees?

Living expenses in the U.S. can vary greatly by state, with some areas having a higher cost of living than others. Retirees should research affordable locations.